by vogey | Jun 4, 2025 | Journal

Financing the Estate Tax with Efficiency and Intentionality Estate tax planning isn’t just about helping lower the taxable base—it’s about ensuring liquidity, preserving business continuity, and reducing administrative burden on the next generation. For many...

by vogey | May 15, 2025 | Journal

David Byers, M Financial’s Board Chair and Principal of Member Firm Capital Strategies Group, has been named the 2024 recipient of Pacific Life’s prestigious Preston Hotchkis Distinguished Achievement Award. This annual award recognizes dedication to the...

by vogey | May 15, 2025 | Journal

In high-net-worth planning, the wrong insurance product doesn’t just cost more—it performs worse over time. That’s why M Financial’s exclusive life and disability solutions, available only through Member Firms like ours, are engineered specifically for the unique...

by vogey | Mar 5, 2025 | Journal

We are deeply grateful to be ranked in the Chambers High Net Worth guide for the fifth consecutive year. This recognition reflects the trust and relationships we’ve built with our clients and partners over the years. Here are just a couple of the statements made by...

by vogey | Jun 17, 2024 | Journal

The use of intergenerational split dollar, when implemented properly, can be a dynamic planning tool for every generation. A review of three recent cases, Levine, Cahill, and Morrissette, can be instructive. The attached white paper from M Financial explores key...

by vogey | Jun 17, 2024 | Journal

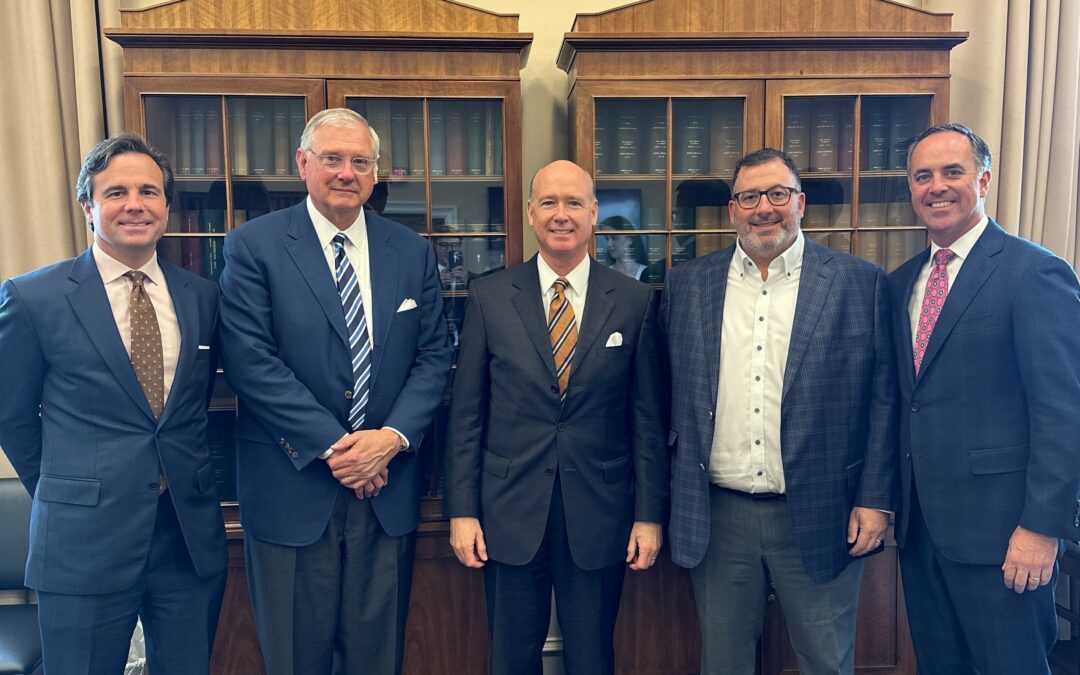

David Byers and Will Worrell of Capital Strategies, along with Marc Cadin (CEO of Finseca), recently met with Robert Aderholt (AL-R) on Capitol Hill. Topics of discussion included recently proposed DOL regulations and the need for stability in estate planning for...

Recent Comments